If your child is deciding between two schools based on a financial aid package, be sure to weigh the taxes that may accompany the offer.

Families depend on scholarships, assistantships and grants to help them afford higher education.

Indeed, the annual cost of tuition, fees, room and board at a public four-year college hit $19,080 for the 2018-2019 school year, according to the College Board. And it was $46,680 for private schools.

The upside of scholarships and other "free money" opportunities is that you don't have to pay them back, unlike loans. However, there is a catch: Scholarships and assistantships may be subject to income tax.

In general, scholarships that cover tuition and fees are tax-free, while money that pays for room and board is not.

Telling the difference between the two is harder than it seems.

"The problem you run into is when the school says, 'We're giving you $10,000 and calling it a scholarship,'" said Tim Steffen, CPA and director of advanced planning at Robert W. Baird & Co. in Milwaukee. "Just because the school says it's tax-free, doesn't mean it is."

Tax-free conditions

Blend Images - Terry Vine | Brand X Pictures | Getty Images

Two conditions must apply in order for a scholarship or fellowship to be tax-free, according to the IRS.

1. You're a degree-candidate at an educational institution that maintains a regular faculty and curriculum. The school must have a regularly enrolled body of students in attendance.

2. The money you receive is used to pay for tuition and fees necessary for enrollment or for books, fees, supplies and equipment needed for courses.

Scholarships that cover incidental expenses, including room, board and travel are taxable.

You are also on the hook for taxes on any money you get as payment for teaching, research and other services as a condition of receiving the cash.

More from Personal Finance:

What you need to qualify for public service loan forgiveness

Government may forgive student loans if you meet demands

Education Dept. fails on public service loan forgiveness: Senators

You might also owe taxes on the portion of a scholarship that exceeds the total tuition, fees, books, supplies and equipment — even if the funds are earmarked for those costs, said Mark Kantrowitz, student loan expert and VP of research at Savingforcollege.com.

Students who get money for services required by the National Health Services Corps Scholarship Program or the Armed Forces Health Professions Scholarship and Financial Assistance Program don't need to pay taxes on the amounts received.

Tuition waivers and stipends show chapters

Saving for college 1:03 PM ET Tue, 6 Nov 2018 | 01:04

Fellowships and research assistantships are a little more complicated. These programs may combine a tax-free tuition waiver and a taxable living stipend.

The stated purpose of the funds and how you use the money will matter.

"Let's say that you get a partial tuition waiver and a living stipend, and you use the stipend to pay the tuition," said Kantrowitz.

"It will still be treated as taxable because it was designated for living expenses, as opposed to tuition," he said.

Reporting to the IRS

Nora Carol Photography | Getty Images

If a school offers a student money that's considered taxable income — perhaps as part of a teaching assistantship or fellowship — then it must provide the student with a Form W-2, reporting taxes withheld.

Prior to tax time, your school will also report qualified tuition expenses on Form 1098-T, along with the details on the amount of scholarships, fellowships and grants received.

Hold onto your receipts for textbooks, supplies and equipment, Kantrowitz said. Form 1098-T won't have that information.

Who's ultimately responsible for reporting the tax load? For dependent students, Mom and Dad would report the scholarships on their return.

In this case, a taxable scholarship is considered "unearned income," subjecting it to the kiddie tax if the child is under 19 or is a full-time student under age 24, Steffen said.

Under the old tax code, this would've meant that unearned income exceeding $2,100 is subject to the parents' rates, and families would use Form 8615 to calculate the liability.

Under the new tax law, however, the "unearned income" will instead be subject to trust income tax rates — meaning that taxable income exceeding $12,500 will be taxed at the top rate of 37 percent.

Subscribe to CNBC on YouTube.

Torchmark Co. (NYSE:TMK) EVP Robert Brian Mitchell sold 12,000 shares of Torchmark stock in a transaction on Monday, March 11th. The shares were sold at an average price of $81.67, for a total value of $980,040.00. Following the completion of the transaction, the executive vice president now directly owns 51,808 shares of the company’s stock, valued at $4,231,159.36. The sale was disclosed in a legal filing with the SEC, which is available through this link.

Torchmark Co. (NYSE:TMK) EVP Robert Brian Mitchell sold 12,000 shares of Torchmark stock in a transaction on Monday, March 11th. The shares were sold at an average price of $81.67, for a total value of $980,040.00. Following the completion of the transaction, the executive vice president now directly owns 51,808 shares of the company’s stock, valued at $4,231,159.36. The sale was disclosed in a legal filing with the SEC, which is available through this link.  Blend Images - Terry Vine | Brand X Pictures | Getty Images

Blend Images - Terry Vine | Brand X Pictures | Getty Images  Saving for college 1:03 PM ET Tue, 6 Nov 2018 | 01:04

Saving for college 1:03 PM ET Tue, 6 Nov 2018 | 01:04  Nora Carol Photography | Getty Images

Nora Carol Photography | Getty Images

A P MOLLER-MAER/ADR (OTCMKTS:AMKBY) was upgraded by Zacks Investment Research from a “sell” rating to a “hold” rating in a report issued on Monday.

A P MOLLER-MAER/ADR (OTCMKTS:AMKBY) was upgraded by Zacks Investment Research from a “sell” rating to a “hold” rating in a report issued on Monday.

Source: Shutterstock

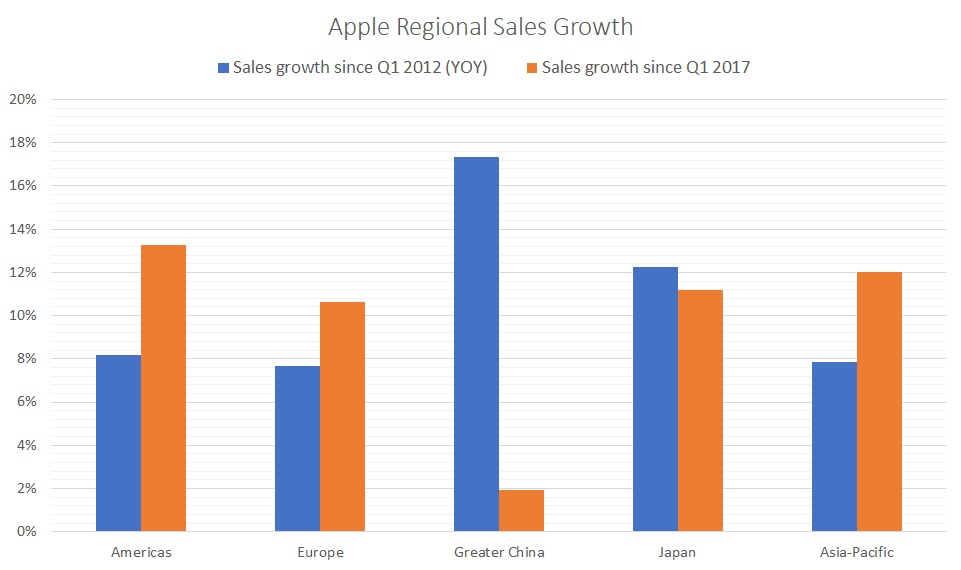

Source: Shutterstock  Since the first quarter of 2012, China has unquestionably been the king of Apple’s growth. On a year-over-year basis, Apple’s “Greater China” sales have risen by an average of 17.4%. No region besides Japan experienced double-digit growth over that period.

Since the first quarter of 2012, China has unquestionably been the king of Apple’s growth. On a year-over-year basis, Apple’s “Greater China” sales have risen by an average of 17.4%. No region besides Japan experienced double-digit growth over that period. 24/7 Wall St.

24/7 Wall St.