Image source: The Motley Fool.

Global Net Lease Inc (NYSE:GNL)Q4 2018 Earnings Conference CallFeb. 27, 2019, 11:00 a.m. ET

Contents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks:

Operator

Good day and welcome to the Global Net Lease, Fourth Quarter Earnings Conference Call and Webcast. All participants will be in listen-only mode. (Operator Instructions) Please note this event is being recorded.

I would now like to turn the conference over to Louisa Quarto, Executive Vice President. Please go ahead.

Louisa Hall Quarto -- Executive Vice President

Thank you, operator. Good morning everyone and thank you for joining us for GNL's fourth quarter 2018 earnings call. This call is being webcast in the Investor Relations section of GNL's website at www.globalnetlease.com. Joining me today on the call to discuss the quarter's results are, Jim Nelson GNL's Chief Executive Officer and Chris Masterson, GNL's Chief Financial Officer.

The discussion today will include certain statements and assumptions, which are not historical facts. They are forward looking in nature and are being made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The following discussion and analysis should be read in conjunction with the accompanying financial statements.

The following information contains forward-looking statements, which are subject to risks and uncertainties. The one or more of these risks or uncertainties materialize, actual results may differ materially from those expressed or implied by the forward-looking statements. We refer all of you to our SEC filings, including the Form 10-K filed for the year ended December 31st, 2017, filed on February 28, 2018, and all other filings with the SEC after that date for more detailed discussion of the risk factors that could cause these differences.

Also during the call, we will use the term investment grade rating, which includes both actual investment grade ratings of the tenant and implied investment grade rating. Implied investment grade can include ratings of the lease guarantor or the tenant parent, regardless of whether or not the parent has guaranteed the tenant's obligation under the lease.

Implied investment grade ratings can also include ratings determined using a proprietary Moody's analytical tool, which compares the risk metrics of the non-rated company to those of a company with an actual rating. The ratings information is as of December 31st, 2018. Any forward-looking statements provided during this conference call are only made as of the date of this call. As stated in our SEC filings, GNL disclaims any intent or obligation to update or revise these forward-looking statements except as required by law.

Also during today's call, we will discuss non-GAAP financial measures, which we believe can be useful in evaluating the Company's financial performance. These measures should not be considered in isolation or as a substitute for our financial results prepared in accordance with GAAP. A reconciliation of these measures to the most recent directly comparable GAAP measure is available in our earnings release.

I'll now turn the call over to our CEO, Jim Nelson.

James L. Nelson -- Chief Executive Officer and President

Thank you, Louisa and thanks again to everyone for joining us on today's call. It has been a year-and-a-half since I became GNL's CEO and I'm very proud of the tremendous progress and growth we've achieved in our global real estate portfolio. It is these achievements that distinguish us in the marketplace and we will continue to build on this positive momentum in 2019 and beyond. Our team relies on six key drivers which guide management in the operation of Global Net Lease.

First, there is a focus on owning and operating a high quality mission critical diversified portfolio. At the end of 2018, GNL's portfolio has grown to over $3.5 billion, made up of 342 properties located in the U.S. and six Western European countries. This portfolio includes the 23 properties that GNL purchased in 2018, for a combined contract purchase price of $478 million. These properties provide additional quality and diversification to GNL's overall portfolio.

Second, an important part of GNL's long-term strategy is to focus on leases with long durations that are backed by investment grade and credit-worthy tenants. The Company has demonstrated its ability to source and acquire these types of properties, which provide safe and durable rental income. At the end of 2018, GNL's weighted average lease duration was 8.3 years and it's investment grade and implied investment grade tenant base represents 78.3% of the overall portfolio.

Third, GNL pursues a differentiated strategy with both U.S. and international exposure. The Company maintains a good balance of U.S. and Western European properties with a 55.7% U.S. and 44.3% Western European mix.

Fourth, we utilized proactive asset management to drive long-term portfolio value. As an example, the Company recently agreed to opportunistically sell three European assets for a gain and will generate EUR72.5 million in proceeds available for reinvestment in the U.S. and Europe.

Fifth, an experienced and robust management team. The Company's capabilities are enhanced through professionals based in London, Luxembourg, Charlotte, Newport and New York with specialists across multiple segments including acquisitions, finance, accounting, legal and property management. The Company benefits from this Group's breadth of knowledge and talent.

And Sixth, as a global Company, we believe GNL has the ability to capitalize on differences between the U.S. and European markets to deliver superior risk adjusted returns. Over this past year, GNL acquired $478 million of acquisitions with an average cap rate of 7.70% with a focus on U.S. industrial and distribution properties. The Company also closed on several different debt financing into both U.S. and Europe including the upsizing of the credit facility by $192 million and the GBP230 million UK debt refinancing at an improved interest rate. These financing demonstrate the different sources of capital GNL has access to, in order to optimally finance the Company's global portfolio.

Now, I will begin to review of the key milestones GNL achieved during 2018. Chris will then go into more detail regarding our financial performance. We anticipate settlement of the outstanding litigation with our former European service provider. In connection with this, we recorded a $7.4 million reserve, which is a one-time non-recurring expense that affects net income and FFO, but has no impact to the Company's AFFO. We are extremely pleased with the anticipated resolution.

Turning to several of GNL's key metrics. It is clear that the Company made significant progress in 2018 from 2017. Revenue increased to $282.2 million and 8.8% increase. Net income attributable to common stockholders was $1.1 million, which includes a one-time $7.4 million anticipated settlement with our former European service provider. Adjusted funds from Operations or AFFO, increased 4.7% to $147.3 million. Real estate portfolio increased to over $3.5 billion from less than $3.2 billion. Investment grade or implied investment grade tenants increased to 78.3% from 76.3% and remaining debt maturity increased to 4.2 years from 3.7 years.

Over the course of 2018, GNL continue to execute on its disciplined long-term strategy of acquiring and managing a portfolio of high quality assets net leased on a long-term basis to predominantly investment grade and credit-worthy tenants in the U.S. and in Western Europe. During the year, GNL acquired 23 properties for a combined contract purchase price of $478 million and sold two properties for gross proceeds of $25.3 million.

GNL's acquisitions are broken down as follows: 16 industrial properties acquired for $242.5 million with a weighted average lease term of 12.1 years and six distribution facilities acquired for $181.7 million with a weighted average lease term of 10.1 years and one office property acquired for $54 million with a lease term of 12 years. In their first full year within the portfolio, these 23 assets will contribute approximately $36 million in additional annualized straight-line rental revenue, based on existing in-place leases.

The properties were acquired with a combination of cash-on-hand, equity proceeds and debt financing. Additionally, GNL already has $53 million of additional acquisitions under executed LOI or PSA plus over $200 million of LOIs currently submitted for potential acquisitions. To execute on the Company's long-term growth strategy, GNL accessed the equity capital markets with two common equity offerings and issuances through the ATM program in 2018. Raising a total of $179 million in common equity capital during 2018 at an average gross price of $20.46 per share.

The company used these funds to close on $212 million in acquisitions made during the fourth quarter. As of 12/31/2018, GNL's total liquidity was $143 million and subsequent to year-end GNL raise an additional $153 million in equity capital through its ATM program at an average price of $19.69 per share.

Proceeds from the equity issuances will continue to be used to fund new acquisitions and for general corporate purposes. As part of our asset management strategy during 2018, GNL disposed of two properties for gross proceeds of $25.3 million, which is inclusive of a $3 million lease termination fee. The Company also entered into a contract to sell three additional properties located in Germany for a contract sale price of EUR135 million, which is an EUR11 million premium to the original purchase price of these assets. We expect this disposition to result in a recognized gain of approximately $40 million. Additionally, we expect the sale to generate approximately EUR72.5 million in net proceeds after debt repayment and the Company plans to redeploy those proceeds into accretive acquisitions.

Now I will discuss GNL's fourth quarter activity. During the quarter, GNL closed on six properties for approximately $212 million. These six properties were purchased at a weighted average going in cap rate of 6.67% with a weighted average cap rate of 7.23% and a weighted average remaining lease term of 12.3 years, all six of the property served a critical function for the underlying tenants and the buildings are split evenly between industrial and distribution.

GNL funded the transactions with mortgage debt and cash-on-hand, which includes proceeds from its November public offering. The Company also entered in a new 10-year $98.5 million mortgage loan with a fixed interest rate of 4.85%, which was used to pay down the credit facility. The quality of GNL's portfolio remains strong in several metrics.

GNL's investment grade or implied investment grade tenants make up 78.3% of the portfolio, up from 76% at the end of 2017. Occupancy remained strong at 99.2% at the end of the quarter. The geographic mix based on annualized straight-line rents sits at 55.7% U.S., 44.3% Europe. While GNL's property mix was at 53% Office, 39% Industrial and Distribution, and a 8% Retail.

The Company has continued to increase its exposure to the growing and robust industrial and distribution sector as GNL increased its concentration by 7% of its total portfolio in 2018. GNL's overall portfolio consists of 342 properties and provides predictable consistent cash flow through long-term net leases that include contractual rent growth.

Heading into 2019, we will continue to execute on our long-term strategy to grow GNL's global and diversified portfolio. Our demonstrated ability to underwrite transactions with an eye toward long-term value is what continues to set GNL apart in the net lease sector.

With that, I'll turn the call over to Chris to walk through the operating results in more detail and then I will follow up with some closing remarks. Chris?

Christopher Masterson -- Chief Financial Officer, Treasurer and Secretary

Thanks, Jim.

GNL saw improved financial results for both Q4 2018 annual and quarterly results in comparison to the prior year. For the 2018 year, GNL's revenue increased 8.8% to $282.2 million, with net income attributable to common stockholders of $1.1 million, which includes a one-time $7.4 million anticipated settlement with our former European service provider.

FFO decreased 0.9% to $131.4 million, FFO also includes the $7.4 million accrual. Core FFO increased 10.8% to an $149.1 million and AFFO was up 4.7% to $147.3 million. The Company paid common stock dividends to investors of $147.4 million in 2018, up from $142.7 million in 2017. Revenues increased primarily due to rental income from acquisitions and rent escalators embedded in existing leases.

As always, a reconciliation of GAAP net income to the non-GAAP measures can be found in our earnings release. In the fourth quarter, revenue increased 6.9% to $71.2 million on a year-over-year basis. FFO decreased 18% to $28.3 million, which included the one-time anticipated settlement with our European service provider and our core FFO increased 8.3% to $36.9 million.

GNL's adjusted funds from operations or AFFO, increased 5.6% to $37.1 million and during the quarter, the Company paid common stock dividends of $39.1 million. I would like to note that GNL's $212 million of acquisitions were all purchased on or after November 14th and four of the six acquisitions were purchased in the second half of December.

These acquisitions were financed in conjunction with the Company's $81 million equity raise in late November 2018. We expect a $2.5 million step up in rental income in Q1, 2019 or about $0.03 on a per share basis as the Company will benefit from the full impact of the $212 million of acquisitions acquired in Q4 2018.

On the balance sheet, GNL ended the fourth quarter with net debt, which is debt less cash and cash equivalents of $1.7 billion at a weighted average interest rate of 3.1%. GNL's weighted average maturity at the end of the fourth quarter of 2018 was 4.2 years, which is improvement from 3.7 years at the close of the 2017 fourth quarter.

The components of GNL's debt include $363.9 million on the multi-currency revolving credit facility, $282.1 million on the term loan and $1.1 billion of outstanding gross mortgage debt. This debt was approximately 79.9% fixed rate, which is inclusive of floating rate debt with in-place interest rate swaps. The Company has a robust interest coverage ratio of 3.8 times.

As of December 31st, 2018, liquidity was approximately $142.6 million, which comprises to $100.3 million of cash-on-hand and $42.2 million of availability under the credit facility. GNL's net debt to enterprise value was 53.3% with an enterprise value of $3.2 billion based on the December 31st, 2018 closing share price of $17.62 per common shares and $24.68 per Series A preferred shares.

The net debt to enterprise value would improve to 50.8% if the calculation was based on closing share prices from February 22nd of $19.67 for common shares and $25.17 for preferred shares. 2018 was an active year for our accounting and finance teams. GNL closed our new debt facilities refinanced in-place that an upsized existing facilities across three currencies an amount equal to $165 million, EUR52 million and GBP230 million.

Financing activity included, successfully closed on an eight properties CMBS loan in the amount of $33 million, closed an upsizing of its unsecured credit facility of $132 million for the multi-currency revolving credit facility portion and EUR51.8 million for the senior unsecured term loan facility portion. Also closed on a GBP230 million syndicated investment facility loan agreement, which was secured by all 43 of GNL's properties in the United Kingdom. This refinancing lowers the cost of borrowings on the UK assets from 3.4% to approximately 3.2%.

On February 6, 2019, GNL entered into a syndicated investment facility loan agreement in the amount of EUR74 million. The loan is secured by all five finished properties owned by GNL. The maturity date of the loan is February 1st, 2024, and it bears interest rate at three-month Euribor plus 1.4%. 80% of the principal amount of the loan is fixed at 1.8% by the interest rate swap agreement. This refinancing significantly lowered the borrowing costs from 2.3% to 1.7%.

As a quick update to GNL's hedging program, we have continued to use our hedging strategy as a way to offset movements in interest rates and local currencies for our European portfolio.

In regards to currency hedging, the Company employs disciplined strategy of layering hedges against the two currencies over upcoming quarters to manage some exposure to both currencies.

With that, I'll turn the call back to Jim for some closing remarks.

James L. Nelson -- Chief Executive Officer and President

Thanks Chris. GNL's portfolio is in great shape, with 273 properties in the U.S. and 69 in the UK and Western Europe representing 55.7% and 44.3% of rental revenue respectively. Overall, the portfolio was 99.2% leased and as a weighted average 8.3 years with no near-term expirations. There has been measurable improvement in 2018 across several segments and our steady execution and deliberate focus on high-quality acquisitions continues to drive strong results, including the following:

In 2017, GNL acquired 12 properties for $99 million; while in 2018, the Company acquired 23 properties for nearly $500 million at a going in CAP rate of 7.21% and an average cap rate of 7.70%. 96% of the properties acquired in 2018 include embedded, contractual with average annual rent growth of 1.6% per year based on existing in-place leases.

GNL has an attractive and stable 3.1% weighted average cost to debt at year-end 2018, along with an improved weighted-average remaining lease term of 4.2 years. Our intentional focus is on building portfolio diversification with a focus on an increased mix of industrial and distribution properties.

GNL's acquisition activity of nearly $500 million in 2018 led to an increased portfolio concentration of industrial and distribution property, as this property type now represents 39% of GNL's portfolio at the end of 2018, up from 32% at year-end, 2017. The strength of GNL's portfolio is demonstrated by its high level of leases that are leased to or guaranteed by investment grade or implied investment grade tenants.

As of December 31, 2018, that figure had increased to 78.3%, up from 72.6% at year-end 2015. The year that GNL listed on the New York Stock Exchange. GNL continues to demonstrate a proven ability to source investment opportunities by leveraging direct relationships with landlords and developers to identify off market transactions.

We believe this allows the Company to achieve better than market cap rates at more favorable terms that are generally available. This execution generates improved results for the Company and its shareholders. We will remain proactive and disciplined in our acquisition strategy to identify compelling opportunities to acquire net lease assets, with a continued near-term focus on U.S. industrial and distribution facilities. We will also remain opportunistic when it comes to selectively adding to our international footprint. My last 1.5 years have been exciting and fulfilling, and as we move forward toward the future, we will continue to drive slow and steady growth to enhance long-term value for shareholders.

With that operator, we can open the line for questions.

Questions and Answers:

Operator

(Operator Instructions) The first question today comes from Mitch Germain with JMP Securities. Please go ahead.

Mitch Germain -- JMP Securities -- Analyst

Thanks for taking question. I appreciate it. Chris, if I was to look at -- I think I saw a leverage based on 4Q annualized was 7.9 times, but does that include if I looked at the acquisitions as of day one of the quarter and if that's not, what would that leverage look like if I assume the full quarter or full-year of those acquisitions?

Christopher Masterson -- Chief Financial Officer, Treasurer and Secretary

Right. So, that leverage does not include the acquisitions as if they were on the books as of day one. The actual rental income that is reflected in that number is actually less than a third of what the total would be. So, it's actually $2.5 million more rental income, which would be flowing through, if they were in place as of the first day of the quarter. So, it would definitely drop the number from 7.9 too much lower in the 7s.

Mitch Germain -- JMP Securities -- Analyst

Got you. Got you. And I apologize, I missed some of your prepared comments. Where do we stand on liquidity now with regards to your ability to execute on further acquisitions?

Christopher Masterson -- Chief Financial Officer, Treasurer and Secretary

Sure. So, we're actually in a very strong position as of year-end, we had $100 million in cash, $42 million of availability on the credit facility. Then in January, we actually raised $153 million on our ATM. So with that, we then paid down $130 million on the revolver, which we can draw as needed. We also added some additional properties to our revolver borrowing base, which increased our capacity by about $50 million.

Mitch Germain -- JMP Securities -- Analyst

So what's -- what's the total capacity of the revolver today in terms of -- what's the total size and then what's the availability, is that a better way to say?

Christopher Masterson -- Chief Financial Officer, Treasurer and Secretary

Okay. So the total size is up to about roughly $917 million which could fluctuate fluctuate with the FX. In terms of where we are with capacity -- back of the envelop now -- we have over $250 million.

Mitch Germain -- JMP Securities -- Analyst

Great, that's very helpful. Jim, you guys had some real good success in the fourth quarter, but even the whole year, what changed. I mean, I think you're probably almost more than four times, so what you guys did an acquisition volumes in the year before that. What sort of directive -- what sort of change created the increased activity?

James L. Nelson -- Chief Executive Officer and President

Well, you know, we -- as a strategy for the Company, we are looking at growing the business, doing accretive acquisitions and building a stronger, better, bigger company. So, we've just started executing on all eight cylinders and the acquisition guys found a lot of great stuff. We were able to raise money, so all things considered, everything worked well and we are still moving ahead the way we did last year.

Mitch Germain -- JMP Securities -- Analyst

Great, last one for me. And again, I apologize if I missed it. The sale of the asset that was planned for 2019, I believe those in office building in Germany, is that still on target -- what created the delay there and where does that stand?

James L. Nelson -- Chief Executive Officer and President

We -- the way we structured the sale was to give us time to have acquisitions in our hand to replace the capital. So, we look at closing that toward the middle of the year and that will give us time to have a number of acquisitions to put the money back to work very quickly.

Mitch Germain -- JMP Securities -- Analyst

Great. And just a follow-up on that, do you guys ever disclosed the cap rate or the IRR on that investment for you guys?

James L. Nelson -- Chief Executive Officer and President

We haven't yet.

Mitch Germain -- JMP Securities -- Analyst

Thank you.

James L. Nelson -- Chief Executive Officer and President

Thanks. Good to talk to you.

Operator

Next question comes from Bryan Maher with B. Riley FBR. Please go ahead.

Bryan Maher -- B. Riley FBR -- Analyst

Yes, good morning.

James L. Nelson -- Chief Executive Officer and President

Hi Bryan.

Bryan Maher -- B. Riley FBR -- Analyst

If you answered partially, one of my questions, in your closing remarks as to where you're seeing the best opportunities, and correct me if I'm wrong, but it continues to seem to be U.S. industrial. Is that really where the focus will be in 2019?

James L. Nelson -- Chief Executive Officer and President

That will be, where quite a bit of the focus is, yes. I mean we are still looking in Europe and we underwrite a lot of different types of properties, but that is one of our primary focus, is to grow that part of our portfolio.

Bryan Maher -- B. Riley FBR -- Analyst

And I'm sorry if I missed it, but did you give any estimate as to what the acquisition size would be for 2019 in dollar terms?

James L. Nelson -- Chief Executive Officer and President

We don't usually give guidance, but I think you can take a look back at what we did in 2018, which was a very robust year and we intend to continue in that same vein.

Bryan Maher -- B. Riley FBR -- Analyst

And then just lastly from me, and I'm really interested in hearing how you think about this. When we look at your multiple on EBITDA in kind of just under the the mid-teens. And we look at office REITs in the U.S. trading in the high teens and -- U.S. industrial REITs trading in the low to mid 20s times and European office trading in the high 20s times EBITDA. Is it frustrating to you with where your stock trades? is I guess partially my question, But then you continue to issue equity in a kind of low 20s range and so I'm trying to figure out how you, you kind of rationalize that when I think a case could be made for a mid to high 20s valuation on the stock, but you issue stock in the low '20s?

James L. Nelson -- Chief Executive Officer and President

Well, that's where we issued it now because that's where the stock was trading, but certainly by having great new analysts like you covering the stock, we intend to get the story out to more people, and the more people that are aware of the Company. I think the stock should trade better, more people hear the story. So, I want to thank you for following the Company and we do agree with you.

Bryan Maher -- B. Riley FBR -- Analyst

Flattery will get you everywhere, Jim. So, thank you.

James L. Nelson -- Chief Executive Officer and President

Okay, pal.

Operator

(Operator Instructions) The next question comes from John Massocca with Ladenburg Thalmann. Please go ahead.

John Massocca -- Ladenburg Thalmann -- Analyst

Good morning.

James L. Nelson -- Chief Executive Officer and President

Hi, John.

Christopher Masterson -- Chief Financial Officer, Treasurer and Secretary

Hi John.

John Massocca -- Ladenburg Thalmann -- Analyst

Just trying to kind of -- I think you touched on a little bit. But given all of the equity issuance that happened in January in 4Q and potentially also the proceeds, you're going to get from the sale of the German asset. I mean your leverage is coming down fairly significantly versus where it was even a couple of quarters ago. I mean is this kind of a statement of intent to maybe run the Company at a lower leverage or is this just really creating kind of essentially pre-funding your potential acquisition pipeline for 2019, and that leverage should creep up as maybe some of the things you've submitted LOIs on potentially successfully closed on?

James L. Nelson -- Chief Executive Officer and President

Yes, well. As you know, we're always looking to balance the capital structure. So, we raised common when we could. The market was surprisingly robust last month for the ATM. So, we took advantage of that, but we do have a very strong pipeline and we think we can put that money to work fairly quickly.

John Massocca -- Ladenburg Thalmann -- Analyst

And -- kind of with regards to that $200 million, out of $53 million we kind of know what it is, but that $200 million, I mean what maybe the industrial office mix, is it 90:10 or something closer to 70:30. I know the primary focus has been industrial, but is there some office slipping into that $200 million number?

James L. Nelson -- Chief Executive Officer and President

As you know, last year we bought an office building for $53 million. So that indicates, we still -- if we see a great deal, a great tenant, long-term lease, investment grade quality, we can execute on it, but as we stated, our main focus is on Industrial/Distribution. We continue to execute on those and I think that you'll see a lot of that going forward.

John Massocca -- Ladenburg Thalmann -- Analyst

And then within the existing portfolio, obviously lot still up in the air, but with a lot of different indicators on Brexit. I mean, any of your existing UK tenants indicated any concerns about their operations or need for the assets they leased from you, if there is maybe a hard Brexit or Brexit is more impactful, the kind of that -- as they look to the risk curve...

James L. Nelson -- Chief Executive Officer and President

It's a great question. And if you talk to 10 different people, you will get 10 different responses on Brexit. We talked to a lot other people that we work with, and I think everybody has a wait-and-see attitude. Our assets are performing well. We are happy with the assets that we have. So, I think we'll just wait and see what happens with Brexit. There may be opportunities that open up for us, if there is a hard Brexit or -- but -- I think we'll wait and see. We'll wait and see what happens.

John Massocca -- Ladenburg Thalmann -- Analyst

And then one last one. As you may be look to kind of refinance some of the other European mortgages you have, is the potential kind of benefit you are going to get on rate that you got with the Finland's refinancing. Is that something you would expect on kind of a general basis that something you would expect with additional refinancings you do in Europe?

James L. Nelson -- Chief Executive Officer and President

In looking at the various rates in the different countries, some are lower and some are about the same. I think overall, we will benefit. If you put all of the European financings together, we will see a benefit over the previous loans, as we saw in the UK.

John Massocca -- Ladenburg Thalmann -- Analyst

In Finland, I mean is Finland maybe typical or is Finland kind of an outlier or is it just too hard to tell, so vary so much base from country to country?

James L. Nelson -- Chief Executive Officer and President

Finland was a great rate, but remember we're going from individual mortgages to say, country-specific, roughly country-specific mortgages. So, we are getting better rates combining all the properties together and dealing with the bank that way.

John Massocca -- Ladenburg Thalmann -- Analyst

Okay, that's it from me. Thank you very much.

James L. Nelson -- Chief Executive Officer and President

All right, thank you.

Operator

The next question is a follow-up from Bryan Maher with B. Riley. Please go ahead.

Bryan Maher -- B. Riley FBR -- Analyst

Hey, Jim and Chris, just two quick follow-ups. When we look at your leverage, it's kind of been hanging out in the low 50s, getting a little bit better. What is the goal? Are you comfortable with it hanging out around 50% or do you want to see it get into the mid to high 40s. What is your thought process there?

James L. Nelson -- Chief Executive Officer and President

Well -- we've -- and I think we may have even talked about this before, but we look at the quality of our tenants, the long-term leases, the investment grade -- the high investment grade percentages of our tenants and we're very comfortable with roughly 50% leverage. I think that's sort of a rule of thumb when we look at -- we look at our portfolio, we are very, very comfortable with where we are and we'll see what happens in the future.

Bryan Maher -- B. Riley FBR -- Analyst

And then my other quick question is when we look at the dividend coverage on a CAD payout ratio, it's elevated relative to a number of the other REITs that we cover not alarmingly so, it's a triple net lease situation, but where would you like to see that gravitate to as a payout ratio on CAD?

Christopher Masterson -- Chief Financial Officer, Treasurer and Secretary

Well, I think over time, it will naturally come down as we add these new accretive properties to the income stream. So, I think you'll probably see it come down overtime.

Bryan Maher -- B. Riley FBR -- Analyst

Right, thank you.

Christopher Masterson -- Chief Financial Officer, Treasurer and Secretary

Thank you everybody.

Operator

This concludes our question-and-answer session. I would now like to turn the conference back over to James Nelson, for any closing remarks.

James L. Nelson -- Chief Executive Officer and President

Yeah, just want to thank you all for joining us on today's call, there was some great questions and we look forward to this next year with GNL and reporting to you in the next quarter. So thank you all for dialing in.

Operator

This conference is now concluded. Thank you for attending today's presentation. You may now disconnect.

Duration: 36 minutes

Call participants:

Louisa Hall Quarto -- Executive Vice President

James L. Nelson -- Chief Executive Officer and President

Christopher Masterson -- Chief Financial Officer, Treasurer and Secretary

Mitch Germain -- JMP Securities -- Analyst

Bryan Maher -- B. Riley FBR -- Analyst

John Massocca -- Ladenburg Thalmann -- Analyst

More GNL analysis

Transcript powered by AlphaStreet

This article is a transcript of this conference call produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not assume any responsibility for your use of this content, and we strongly encourage you to do your own research, including listening to the call yourself and reading the company's SEC filings. Please see our Terms and Conditions for additional details, including our Obligatory Capitalized Disclaimers of Liability.

Torchmark Co. (NYSE:TMK) EVP Robert Brian Mitchell sold 12,000 shares of Torchmark stock in a transaction on Monday, March 11th. The shares were sold at an average price of $81.67, for a total value of $980,040.00. Following the completion of the transaction, the executive vice president now directly owns 51,808 shares of the company’s stock, valued at $4,231,159.36. The sale was disclosed in a legal filing with the SEC, which is available through this link.

Torchmark Co. (NYSE:TMK) EVP Robert Brian Mitchell sold 12,000 shares of Torchmark stock in a transaction on Monday, March 11th. The shares were sold at an average price of $81.67, for a total value of $980,040.00. Following the completion of the transaction, the executive vice president now directly owns 51,808 shares of the company’s stock, valued at $4,231,159.36. The sale was disclosed in a legal filing with the SEC, which is available through this link.  Blend Images - Terry Vine | Brand X Pictures | Getty Images

Blend Images - Terry Vine | Brand X Pictures | Getty Images  Saving for college 1:03 PM ET Tue, 6 Nov 2018 | 01:04

Saving for college 1:03 PM ET Tue, 6 Nov 2018 | 01:04  Nora Carol Photography | Getty Images

Nora Carol Photography | Getty Images

A P MOLLER-MAER/ADR (OTCMKTS:AMKBY) was upgraded by Zacks Investment Research from a “sell” rating to a “hold” rating in a report issued on Monday.

A P MOLLER-MAER/ADR (OTCMKTS:AMKBY) was upgraded by Zacks Investment Research from a “sell” rating to a “hold” rating in a report issued on Monday.

Source: Shutterstock

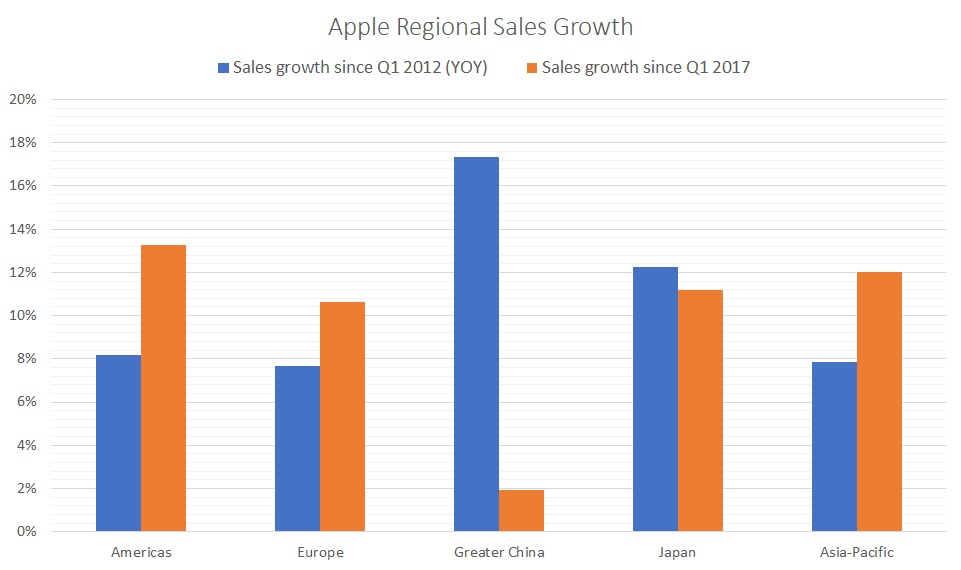

Source: Shutterstock  Since the first quarter of 2012, China has unquestionably been the king of Apple’s growth. On a year-over-year basis, Apple’s “Greater China” sales have risen by an average of 17.4%. No region besides Japan experienced double-digit growth over that period.

Since the first quarter of 2012, China has unquestionably been the king of Apple’s growth. On a year-over-year basis, Apple’s “Greater China” sales have risen by an average of 17.4%. No region besides Japan experienced double-digit growth over that period. 24/7 Wall St.

24/7 Wall St.

Source: Carolyn McClanahan Carolyn McClanahan

Source: Carolyn McClanahan Carolyn McClanahan  Source: Chris Heye Chris Heye

Source: Chris Heye Chris Heye  Source: Gary Vawter Gary Vawter

Source: Gary Vawter Gary Vawter